Happy Friday, we are live.

The current thing is President Trump escalating the rare earths exports situation with China.

Reminder: Sam Altman will be joining the show today at noon PT.

Also, we are hiring a social media lead. Pitch john@tbpn.com if you’re interested.

Today’s lineup

OpenAI’s Sam Altman with Head of Sora Bill Peebles at 12:00

Gil Capital’s Elad Gil at 12:30 PM

Google VP Product at Search Robby Stein at 1:00 PM

The Art of Spending Money author Morgan Housel at 1:20 PM

Reflection AI Co-Founder and CEO Misha Laskin at 1:50 PM

SemiAnalysis Founder Dylan Patel at 2:00 PM

It’s time for another Sam Altman Bubble Talk bet

Back in 2015, everyone was talking about tech being a bubble. Startups were raising at higher prices than the previous year. Therefore: bubble. In fact, one of the first talks I went to when I arrived in Silicon Valley in 2012 was all about how we were a few years deep into a “tech bubble.” Entrepreneurs should be cautious, the speaker told the audience.

But for whatever reason, in 2015, the tech bubble became a bit of a meme, and Sam put $100k on the line in the form of three conditions that had to be met on January 1st, 2020 for him to win.

First: Uber, Palantir, Airbnb, Dropbox, Pinterest, and SpaceX had to be worth at least $200B (they were worth <$100B at the time).

Second: Stripe, Zenefits, Instacart, Mixpanel, Teespring, Optimizely, Coinbase, Docker, and Weebly together had to be worth over $27B (they were worth less than $9B in 2015).

Third: The brand new YC Winter 2015 batch needed to be worth over $3B.

In 2020, Sam Altman lost the bet! But just barely, and not how you’d expect. He missed on the first ‘tranche’: Uber, Pinterest, and Dropbox were getting a bit beat up in the public markets. But if you look at that basket now, it’s easily over $1 trillion.

Even though Sam lost the bet, I regard it as a remarkably accurate forecast. In 2015, everything DID feel overvalued. There were no trillion-dollar companies yet. Apple was ~$700B.

10 years on, we’re talking about another bubble. 2025 is a bit different because there’s a feeling that AI is holding up the entire economy, that a massive wave of debt is on the horizon, and that the consequences of getting this wrong wouldn’t just be a correction in asset prices, but a seriously destabilizing event.

But I’m cautiously optimistic. The bull case is that AI should hold up growth because it’s increasing the efficiency of all parts of the economy. Our economy has been “held up” successfully before by other big booms (industrialization, global trade, information technology, etc.). Debt is fine as long as you understand how what you’re financing generates the cash flows to make regular payments.

In 2012, Peter Thiel argued to Eric Schmidt that Google’s growing cash pile was evidence they had run out of ideas for how to invest in new technologies. Through the lens of ending stagnation, seeing tech companies cut dividends, raise debt, and invest aggressively in a new technology is exactly what we want to see.

Especially when a lot of the spending will be going toward energy infrastructure that can ultimately be used for anything.

So that’s how I would formulate the bet.

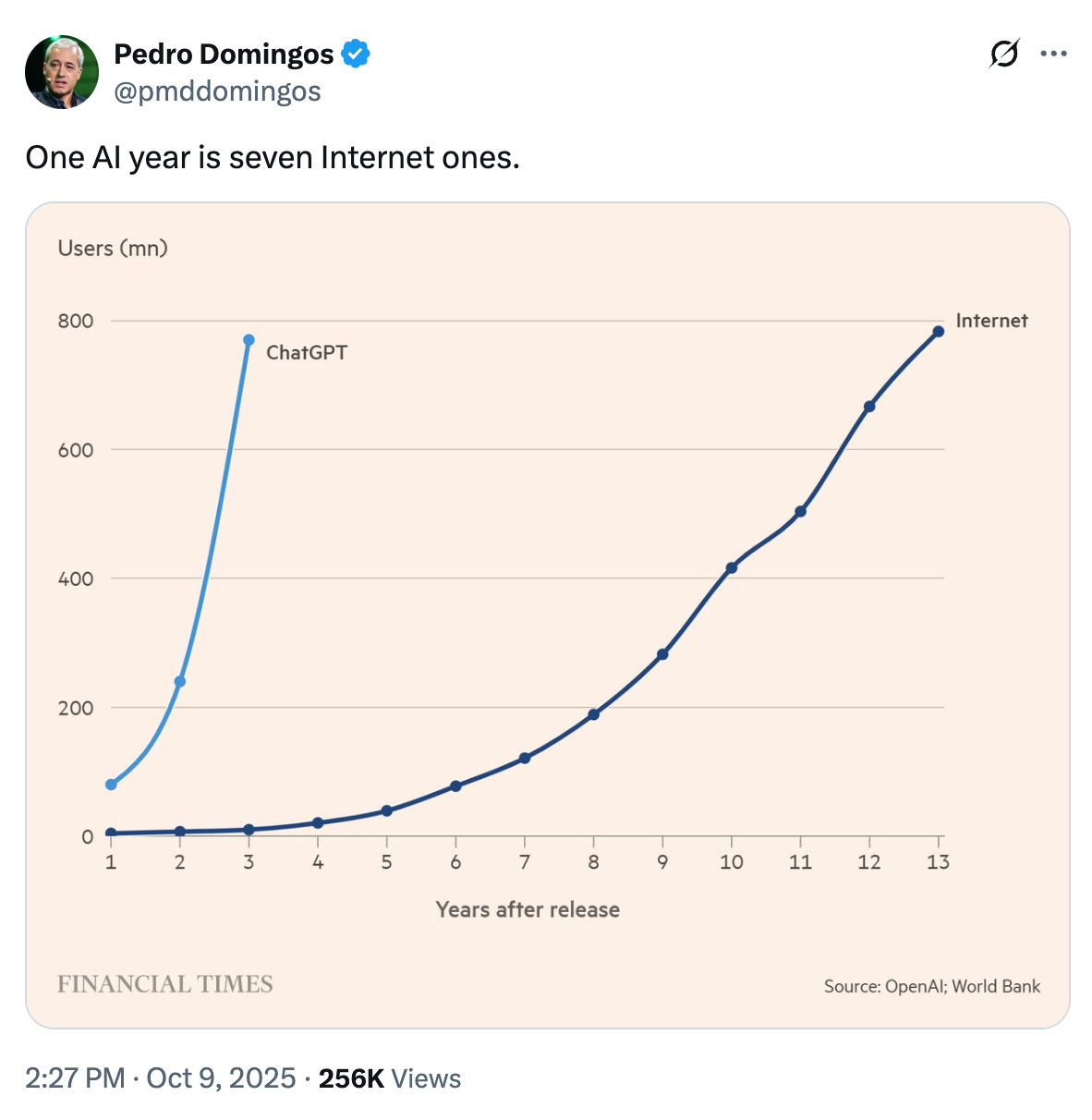

Five years out, in the full year of 2030, three separate lenses on energy consumption:

First: OpenAI’s total electricity consumption will be over 500 TWh.

Second: United States electricity generation will be over 5,000 TWh.

Third: Global data-center electricity consumption will be over 2,000 TWh.

These numbers are super rough, and honestly I have no idea if this is even how Sam is thinking about measuring long-term progress. I haven’t run these by him, but I hope to chat about some of this in our interview with him today at noon. If you know more about energy production or forecasting, let me know how you would formulate this 2030 estimate to a 50% level confidence.

— John

Headlines

Bari sends memo to entire staff in one her first moves as new CBS EIC…

Cloudflare announces rebrand with hard-hitting hype video (sound on)…

Duolingo tops list of OpenAI’s alleged top 30 token consumers…

Dan McCormick goes full time at Create after writing Weekly Dose of Optimism for past three years…

Former British PM Rishi Sunak takes advisory roles at Microsoft and Anthropic…

Bloomberg: SoftBank in Talks for $5 Billion Margin Loan Backed by Arm Stock…

Telegram’s Pavel Durov posts dark birthday tweet…

NYT: A Mystery C.E.O. and Billions in Sales: Is China Buying Banned Nvidia Chips?

Jake Paul takes victory lap re: 1B views via cameos on Sora…

Tesla reportedly scaling back Optimus production due to issues with hand design…

Figure introduces humanoid robot Figure 3…

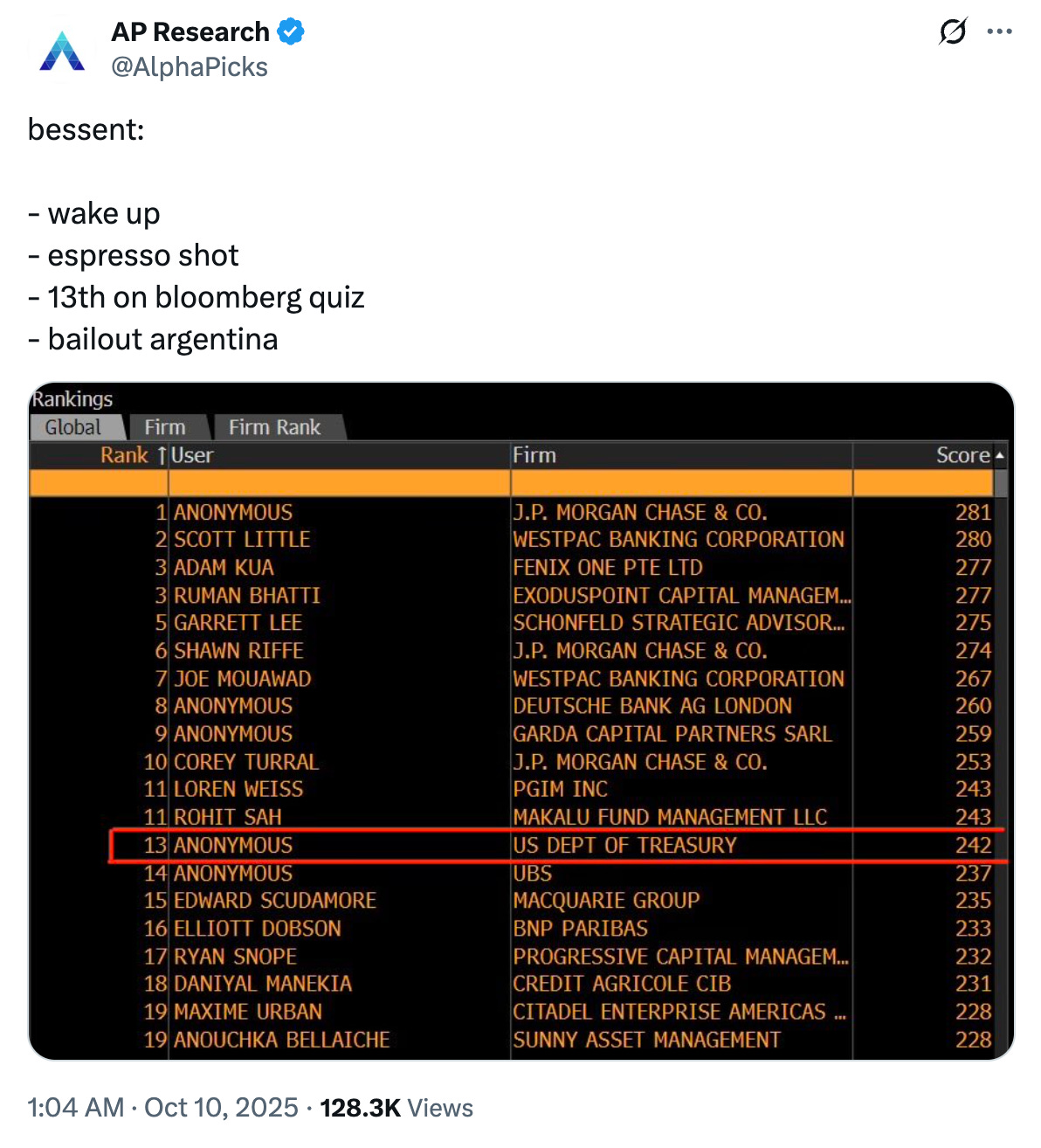

Posts of the day

TBPN is brought to you by Ramp.

Ramp is the all-in-one finance automation platform that helps businesses save time and money with smarter corporate cards, spend management, and bill pay.

Special thanks to our sponsors Fal, Cognition, Privy, Turbopuffer, Restream, Profound, Julius, Numeral, AdQuick, EightSleep, Wander, Bezel, Linear, Figma, Vanta, Attio, Graphite, Fin, Polymarket, and Public.